Market Analysis Review

Daily Market Report: Expert Technical & Fundamental Insights – 25.04.2025

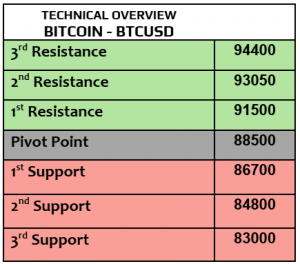

EURUSD

EURUSD traded lower today & fell to $1.1348 amid high volatility & mixed daily performance. Strength of EUR by more than 5% in a month was mainly due to USD weakness & Trump’s chaotic trade policies, giving the traders good reason to sell greenback, it was basically the loss of trust in USD, rather than an economic factor. The markets are likely to re-focus on the Central Banks forward guidance , more economic numbers & the outlook of rate cuts in 2025.

Technical correction would be highly probable ( ongoing now) , targeting $1.1490 then $1.1455 which exactly what happened , $1.1335 will be the next target (executed ) then $1.1270. Both, daily & hourly trend index remained bearish .

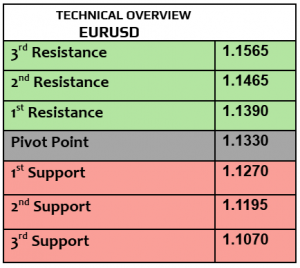

USDJPY

This currency pair is likely to be in the way to the first weekly positive performance in a month, still down by -4.6% in a month. USDJPY gained & advanced today to 143.51. According to the news, there were signs of advancement in trade talks between Japan & the US, which was positive for USD. On the other hand, Tokyo’s inflation increased by 3.5% in April, higher than March of 2.9%, it was the highest in two years, what does that mean? It means that BoJ’s job becomes more complicated than before where the high inflation will force the central bank to raise rates, not to forget the challenges ahead because of Trump’s proposed tariffs on Japan’s exports to the US.

Correction may continue to 143 which was executed then 143.85. Mixed sentiments persisted with bullish trend index in one hour. Price action is still showing the potential to go higher.

GBPUSD

GBPUSD traded slightly lower today at $1.3313 after strong performance on Thursday. Retail sales in the UK improved in March by 0.4%. higher than the estimates. All eyes will remain on the developments of trade talks between America & UK, UK remained the closest ally to the US, economically & politically which means that Trump may impose lower tariffs on the UK than other EU trading partners.

The daily trend index remained bullish , supported by price action that aims higher to $1.3340 then $1.3380. $1.3250 is support for day traders.

GOLD

This week was tough in gold market after gold lost more than -3%, falling again today by another -1.2% to $3306 per ounce. Remember that the traders reacted aggressively to Trump’s tariffs, expecting higher inflation later , that’s why they bought gold as precautious measure, but what if China & America agree on new trade terms & avoid the escalation? Very important question should be considered by all markets’ participants. Gold rose 26% in 2025.

Correction mood continued, targeting $3275 with bearish trend index in one hour. High volatility is likely to continue and forecasts showed bearish mood by most of the traders in weekly outlook.

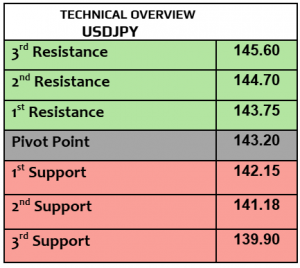

SILVER

It seems that silver benefited from the weekly losses in gold & increased by more than 2% in a week, still down by -0.5% in a month while gold gained 10% in a month. Silver fell today to $33.47 per ounce after falling by almost -1% on Thursday. The improvement of trade talks between World’s two largest economies is likely to have positive impact on silver’s outlook, which means that silver could have higher potential than gold to increase ( if any). China may exempt some US goods from tariffs according to Bloomberg.

Technically speaking, 1H RSI remained neutral, and trend index in 1H was bearish amid low volatility. $33.70 is resistance, $32.80 is support.

Oil-WTI

WTI is on the way to the weekly loss by more than -1%. WTI slightly increased today to $62.88PB, Brent $66.58PB. According to EIA, US crude oil inventories increased by 244K barrels last week, higher than the estimates. At the same time, there were concerns about oversupply, driven by the potential of ceasefire between Russia & Ukraine, and more OPEC+ output as well.

Mixed sentiments persisted among most of the traders who remained sideways. $61.75 is support, $64.20 is resistance. Technical diagram could support further advance but likely to be slow.

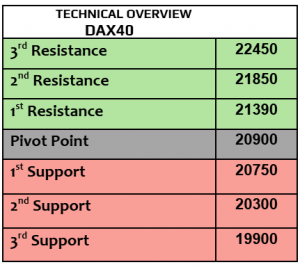

DAX40

It was very strong week in DAX index that still high by more than 4%, trading higher today at 22138. Generally speaking, trade’ hopes were the major catalyst in EZ stock rally, the less trade tensions, the higher the risk appetite is likely to continue, driven by ECB commitment to cut the rates further. German IFO in business climate improved in April, and the economic expectations were better as well.

Even if 1H RSI is heading higher to overbought level, 1H trend index remained bullish. 22470 will be the next target. 21800 is support.

NASDAQ

Nasdaq index gained more than 5% in one week, followed by 2.3% in Dow Jones and 4.2% in SPX, US stock futures traded higher today. US durable goods orders increased by 9.2% in March, which was strongly higher than before but US existing home sales fell by -5% in March. Yesterday, Dow Jones gained 1.2%, SPX 2% & Nasdaq 2.7%. University of Michigan Consumer Sentiments will be released later today. Markets remained in waiting mood, trying to digest Trump’s trade developments & negotiations with China ( if any).

Price action is heading higher today ( correction) & targeting 18100 then 18350, both are executed then 18900 ( executed as well ) then 19400. 18500 is support. 1H RSI is overbought now. Volatility remained high.

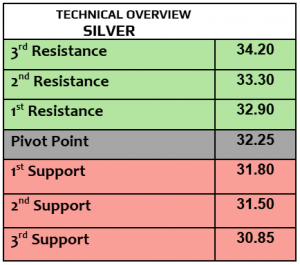

BITCOIN

BTC was little changed today at $93600, Eth $1772, both Cardano & Ripple slightly fell today. According to Crypto news, SEC delays decision on Spot -ETFs for Polkadot & fund for BTC & ETH. Crypto market cap increased again to $2.9 trillion with more than $500 million in crypto ETF’s new flow. Fear & greed index in crypto market improved to 52 today, still in neutral territory, after being in fear sentiment last week ( around 32 ).

$91900 & $86800 is support; however, markets’ sentiments still support further advance to $90600 ( execyted ) , then $94K. Hourly trend index remained bullish.